Market Updates

5th of November 2020

Market Updates for October 2020

|

Dow Jones 30 |

S&P 500 |

Nasdaq |

FTSE 100 |

Euro Stoxx 50 |

Nikkei 225 |

|

-4.73% |

-3.28% |

-3.66% |

-5.14% |

-7.36% |

-0.90% |

|

US 10YR |

Brent Crude |

Gold |

GBP:USD |

EUR:USD |

USD:CNY |

|

0.874% |

$37.45 |

$1,878.61 |

1.295 |

1.1646 |

6.69 |

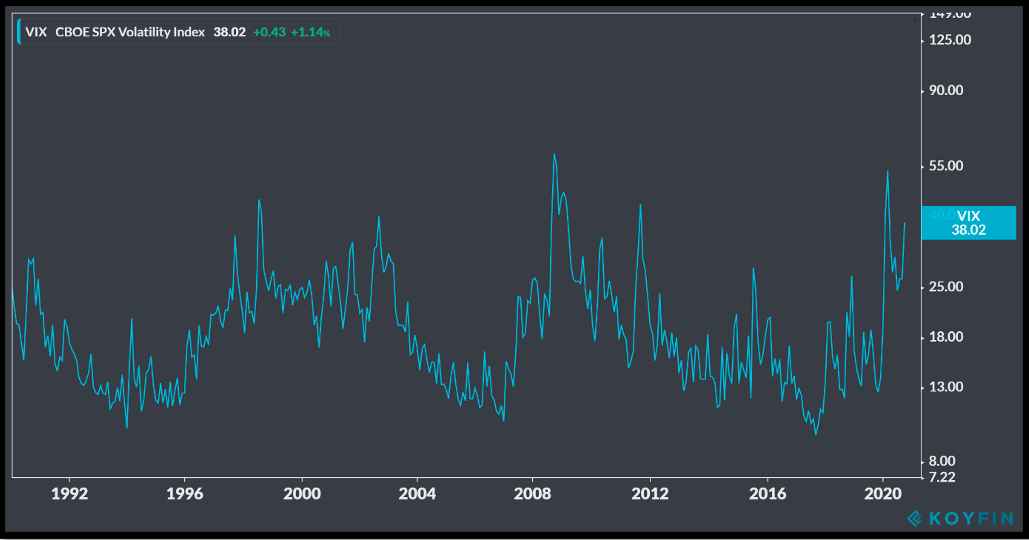

Stocks struggled for a second consecutive month, as volatility picked up markedly to levels not seen since the beginning of the COVID-19 crisis in February. European markets took the brunt of the sell-off, as an array of countries in the region announced countrywide lockdowns. European titans, France and Germany, led the way and were keenly followed by the UK in implementing month long lockdown measures. The week leading into a US election is rarely a calm affair, especially in such a divisive election where the risks surrounding the unknown unknowns rise exponentially. Both candidates have hinted that the results may be challenged should sufficient suspicions arise. Thus the possibility of several months of further uncertainty following the election is clearly welcomed with little enthusiasm.

Chart Source: Koyfin Charts

The sell-off was not limited to equities as sovereign bond yields rose throughout October. The US 10YR yield jumped to 0.87% from 0.65% and continued its upward trend having almost doubled since August. UK gilts were much more capricious, bouncing around in response to varying BREXIT related news, finishing the month at 0.286% (up from a low of 0.076% in August). Brent Crude fell abruptly for a second month straight as the outlook for global oil demand looks increasingly perilous, following the summer period of routinely higher demand. The outlook for rising COVID-19 cases is a well reported factor, but also the keen interest of governments to introduce restrictions irrespective of the economic cost, which deepens with each further lockdown. Oil has now fallen by 18% since the Q3 highs reached in September. Gold was relatively buoyant in October, surprisingly, having participated fairly regularly in this year’s volatility events, despite its safe haven status. Gold is now just 9% below its all-time high reached in August.

Chart Source: Koyfin Charts

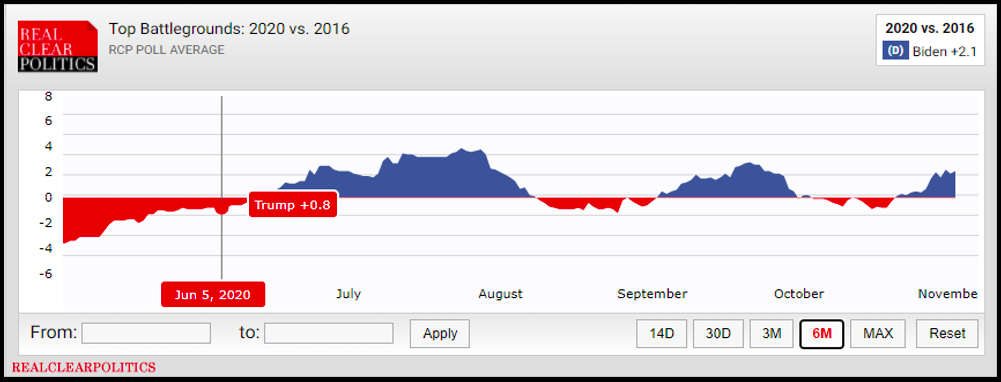

The result of the US election rapidly approaches and qualms remain as to who will be elected on November 3rd, and if there will even be a winner formerly declared. The only matter that is, relatively, agreeable among colleagues and friends is the outlook for Congress. It seems the House will remain in Democratic control unless a significant upset occurs. As a reminder, in the Senate only one third of the seats are up for election every two years. This year’s seats up for grabs are in relatively comfortable territory for Republicans, which should see the GOP retain control of the Senate. In such a scenario, where Congress is split, the scope for future domestic policy direction will be severely limited, irrespective of who is elected President.

This election has been, and continues to be, one of the most volatile elections in American history. Although the polls show President Trump trailing Joe Biden (despite a late resurgence), rallies for the Biden-Harris ticket seem lacklustre. While President Trump speaks unscripted in front of tens of thousands at airport bases, the Biden-Harris campaign hold small and intimate gatherings. Notably Kamala Harris hosted a campaign rally in Asheville, North Carolina, where only ten people were in attendance. North Carolina, in particular, is a key swing state where undecided voters will be required to tilt the overall election result. The other key swing states to watch are Colorado, Florida, Iowa, Michigan, Minnesota, Nevada, New Hampshire, Ohio, Pennsylvania, Virginia, and Wisconsin.

Source: Real Clear Politics

It is worth stating that throughout the majority of October, a month where the decisions of many voters are made, President Trump was polling better than in 2016 in key battlegrounds. Now President Trump is polling 2% worse than the week before the 2016 election. However, this may be less meaningful due to the record amount of mail inn ballots used, as it is estimated that 70% of voters will have done so by the end of October. Pollsters still estimate Biden winning in key states which Trump won in 2016, specifically Pennsylvania, Ohio, Michigan and Wisconsin. President Trump won Iowa by 10 points in 2016, however current polling estimates a tie. Is such a swing possible in a state which so vividly represents President Trump’s voter base? One area of clarity is the lack of future lockdowns in the event of a Trump re-election, thus hinting at a stronger Q1 recovery than is currently priced into financial markets. President Trump continues to reiterate this at each campaign rally which may prove to be fruitful with undecided voters. An example of President Trump’s rhetoric on the matter follows, “I disagree with that because we’re never going to lock down again. We locked down, we understood the disease and now we’re open for business.”

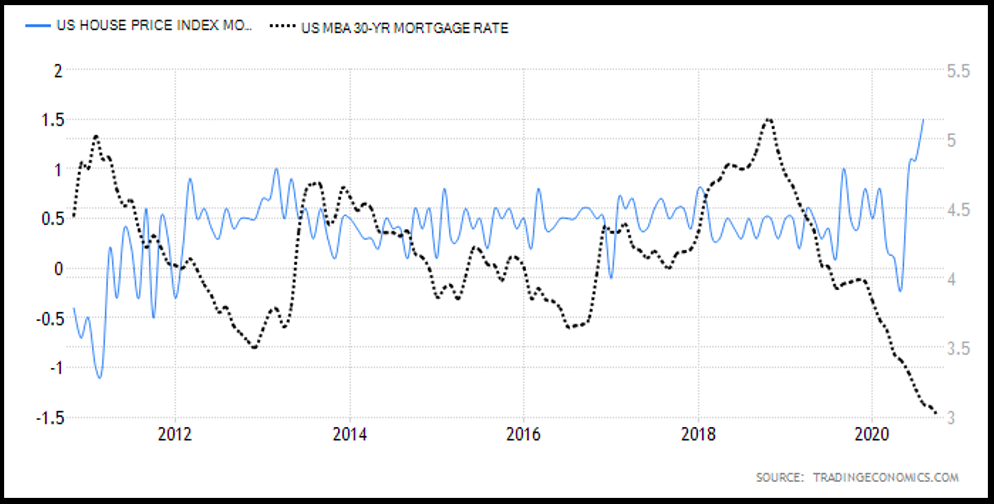

On the economic front, US GDP showed a 33% increase in Q3 on an annualized basis, representing the continued economic recovery experienced throughout the quarter. The US housing sector proceeds and shows no signs of slowing down despite the COVID-19 crisis at hand. Housing Permits granted are steadily rising, reaching levels not seen since the height of the housing boom pre-2008. US house prices, with May being the first month of negative price growth since 2016, expanded strappingly in conjunction with mortgage rates hitting historic lows. Similarly as before COVID-19 the US consumer growth story maintains strength, with YOY% retail sales up 5% having dropped 20% at the height of lockdown in April.

Source: Tradingeconomics.com

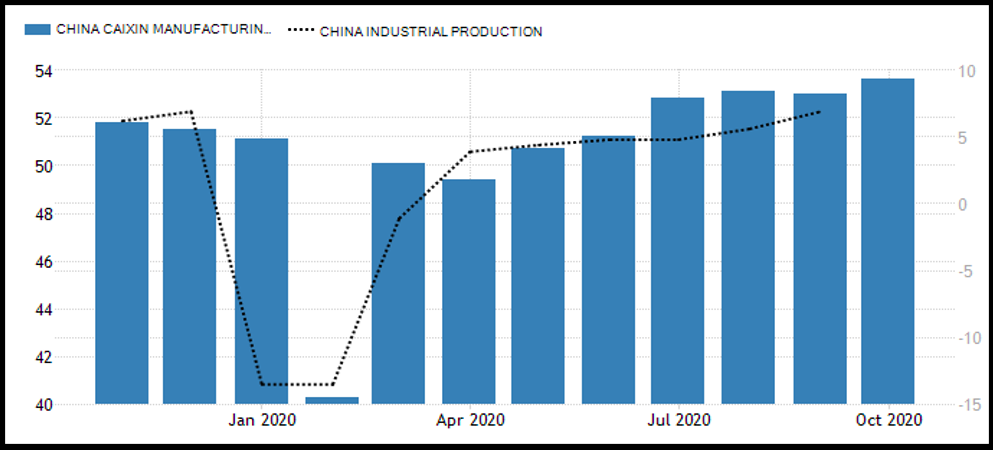

In Asia the economic recovery carries on unabated. The export nature of Japan and South Korea are often useful bellwethers when one is looking to gauge activity in global trade. In Japan leading economic indices show economic activity only marginally lower than pre-COVID-19. Japanese exports to Western buyers fell sharply on a YOY% basis, however are only marginally lower to Asian buyers. Moreover, South Korean GDP contracted by 1.3% on an annual basis, and was also heavily impacted by reduce exports to western nations with exports within eastern Asia remaining comparatively stable. Chinese exports increased by 10% since September of 2019, with these figures being support by strong growth in exports of medical supplies and electronic goods. While traditional ‘hard asset’ exports, such as steel products, plunged by almost 30%, thus representing the unique nature of China’s recovery. In a typical economic recovery exports of steel and Aluminium would be leading indicators rather than lagging. However, Chinese manufacturing indices remain strong indicating that such a trend should cease to continue, and that industrial production should strengthen into year end.

Chart Source: Tradingeconomics.com

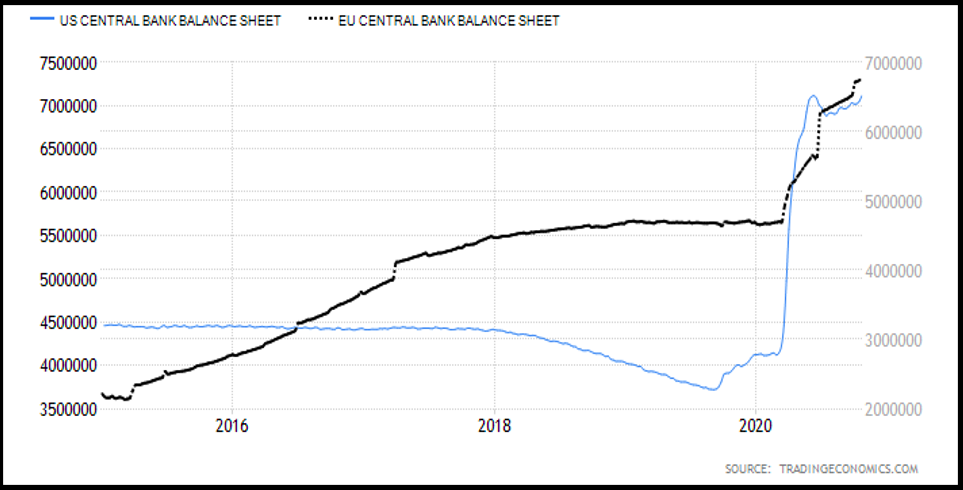

The European Central Bank left monetary policy unchanged during their October meeting, but hinted that a new round of policy measures may well be introduced following the economic projections released in December. Christine Lagarde made it abundantly clear the ECB is ready to flex its tools where possible to best counteract the economic effect of COVID-19 in an attempt to ensure that financing conditions remain buoyant and thus protecting against deflation. The main interest rate was maintained at 0 percent, while the deposit rate remained at a record low -0.5 percent (now for 5 years). In addition, the ECB will continue its purchases under the pandemic emergency purchase programme (PEPP) with a total package of €1.35 trillion. Given the lockdown measures introduced it is widely expected that the ECB will introduce a new round of QE. The EU Commission is still deliberating on the approval of the bloc’s €1.82 trillion budget-and-recovery package.

Chart Source: Tradingeconomics.com

Senior diplomats have acknowledge that it is unlikely that the package will be operationally functional at the start of 2021, which was the original plan, with national leaders eager to deploy cash into their weakened economies. Such a lackadaisical approach will no doubt encourage the ECB to further ease monetary policy once the economic outlook weakens further. However, it would have been unusual for a major central bank to adjust policy in the week before a major political event, such as the US election. October also saw the first federally backed EU bond called SURE bonds. All 16 member states will receive support in the form of loans made on favourable terms. These loans will supposedly help member states cover costs related to the pandemic. Which includes the financing of national short-term work schemes, and other similar measures which have been utilized in response to the pandemic, in particular for the self-employed. The first offering amounted to 17 billion euros, split between 10 and 20 year durations. The 10 year bond, with a 10bn allocation, yielded -0.238%, and demand almost reach 150 billion euros. The 20 year bonds, with the remaining allocation, yielded 0.131% and demand was over 80billion euros. The main takeaway here is that under the current economic climate it is increasingly unlikely that weaker EU nations will be able to raise sufficient debt in capital markets. Federalized bonds, such as these, side-steps this problem. Although, Germany is yet to fully accept this direction of travel and continues to insist on individual state financial prudence.

The UK-EU negotiations broke down mid-October as Boris Johnson’s government walked away from the negotiating table, insisting the EU is not fully respecting the UKs rights as an independent nation. However, talks resumed in London in the last week of October, and will continue in Brussels in early November. According to the withdrawal agreement any agreed treaty must be approved by the end of December, which is a hard deadline. Currently there are no clear indications that both sides will slim down their demands in areas such as state aid, immigration and fishing rights, which are the main areas of congestion. The EU has a habit of dragging out soft deadlines until the hard deadline approaches before agreeing significant terms. The UK-Japan Comprehensive Economic Partnership Agreement (CEPA) was signed on 23rd October, which is the first comprehensive trade deal the UK has signed as an independent nation. The government has declared this as an ‘Important step towards joining the Comprehensive Trans-Pacific Partnership free trade area –which would result in closer ties with 11 Pacific countries’. So far the UK has also signed continuity deals which cover 10% of UK trade, with the Andean and Caribbean countries being the largest respective trade announcements thus far.

Looking forward to November, little else is of significance relative to the outcome and implications of the US general election, and will be keenly monitored by financial markets. As stated above the largest risks arise from the possibility of a contested outcome, which has been mentioned by both candidates on the campaign trail. For UK based investors, the first 2 weeks of November should see clarity emerge on final BREXIT negotiations. Before Boris Johnson and Ursula von de Leyen iron out final amendments mid-month, if at all, assuming an agreement has been reached.

Download this Market Update

Disclaimer

This report was produced by Global Preservation Strategies (“GPS”). The information contained in this report is for informational purposes only and should not be construed as a solicitation or offer, or recommendation to acquire or dispose of any investment. While GPS uses reasonable efforts to obtain information from sources which it believes to be reliable, GPS makes no representation that the information or opinions contained in this report are accurate, reliable or complete. The information and opinions contained in this report are provided by GPS for clients only and are subject to change without notice. You must in any event conduct your own due diligence and investigations rather than relying on any of the information in this report. All figures shown are bid to bid, with income reinvested. As model returns are calculated using the oldest possible share class, based on a monthly rebalancing frequency and all income being reinvested, real portfolio performance may vary from model performance. Portfolio performance histories incorporate longest share class histories but are either removed or substituted to ensure the integrity of the performance profile is met.

The information contained within this website is subject to the UK regulatory regime and is therefore primarily targeted at customers in the UK. The information contained within the websites does not constitute investment advice or a personal recommendation for any product and you should not make any investment decisions on the basis of it. The value of investments and the income from them can fluctuate and it is possible that investors may not get back the amount they invested.

Global Preservation Strategies Limited is registered in England and Wales No 07354963 and authorised and regulated by the Financial Conduct Authority (No. 568328). GPS Wealth is a trading name of Global Preservation Strategies Limited.